Structured Notes compass

Platform to offer a wide range of features designed to bring issuers and investors together, providing a seamless and efficient marketplace for structured notes. Facilitate the connection between issuers and investors, enabling easy access to a variety of structured note offerings.

Market Place

This platform to include a comprehensive dashboard that provides real-time insights into active structured notes, along with indicative prices. This empowers investors to make informed decisions by comparing and analyzing various products from multiple issuers. The dashboard serves as a valuable tool for evaluating pricing and choosing the most suitable structured notes for investment

| Note Type | Index | Maturity | Issuer | Price |

| Reverse Convertible | SPX | 24 M | Morgan Stanley | 99.5 |

| Buffered Note | AAPL | 12 M | JP Morgan | 99 |

| Range Accrual | 30 Y Interest rate | 5y | Barclays | 87 |

| Barrier Note | EUR/USD | 2y | Citi | 95 |

Risk Management

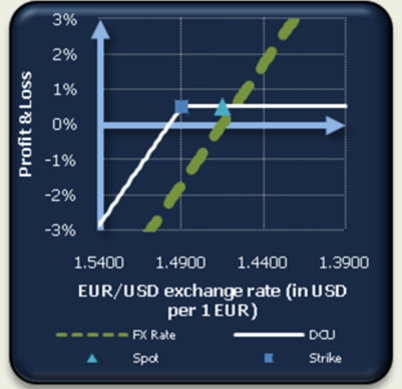

Understanding the risk and reward profiles of structured notes is crucial for effective portfolio management. Our platform offers sophisticated analytical tools specifically designed for risk and return analysis, payoff evaluation, and scenario/what-if analysis. These tools provide investors with a comprehensive view of the risk associated with each structured note, enabling them to make well-informed investment decisions aligned with their risk tolerance and portfolio objectives.

Learning Zone

We recognize that there is often a lack of understanding among investors regarding the workings and benefits of structured products. To address this, our platform includes a dedicated Learning Zone that offers a comprehensive collection of product training videos and a knowledge base. This educational resource equips investors with the necessary knowledge to navigate and leverage structured products effectively.

Workflow Management

Managing the life cycle events of structured products can be complex, with various features such as triggers, coupon payments, and more. Our platform provides a robust workflow management capability, serving as a one-stop shop for investors to efficiently manage all aspects of structured note life cycles. This feature streamlines the administrative tasks associated with structured notes, saving time and effort for both issuers and investors.By integrating these features into our structured notes platform, we aim to enhance accessibility, transparency, and risk management capabilities for investors and issuers. Our goal is to empower users with the tools and knowledge necessary to effectively engage with structured notes, ultimately optimizing their investment strategies and outcomes.